Why Should You Consider Using A Financial Coach

Here are some very common and important reasons why my clients might choose to seek out the services of a financial coach:

- Understanding Your Retirement Vision

- Money Mindset & Confidence

- Knowledge & Education Gaps

- Family & Money Discussions

- Life Transitions & Identity

- Building A Decision-Making Framework

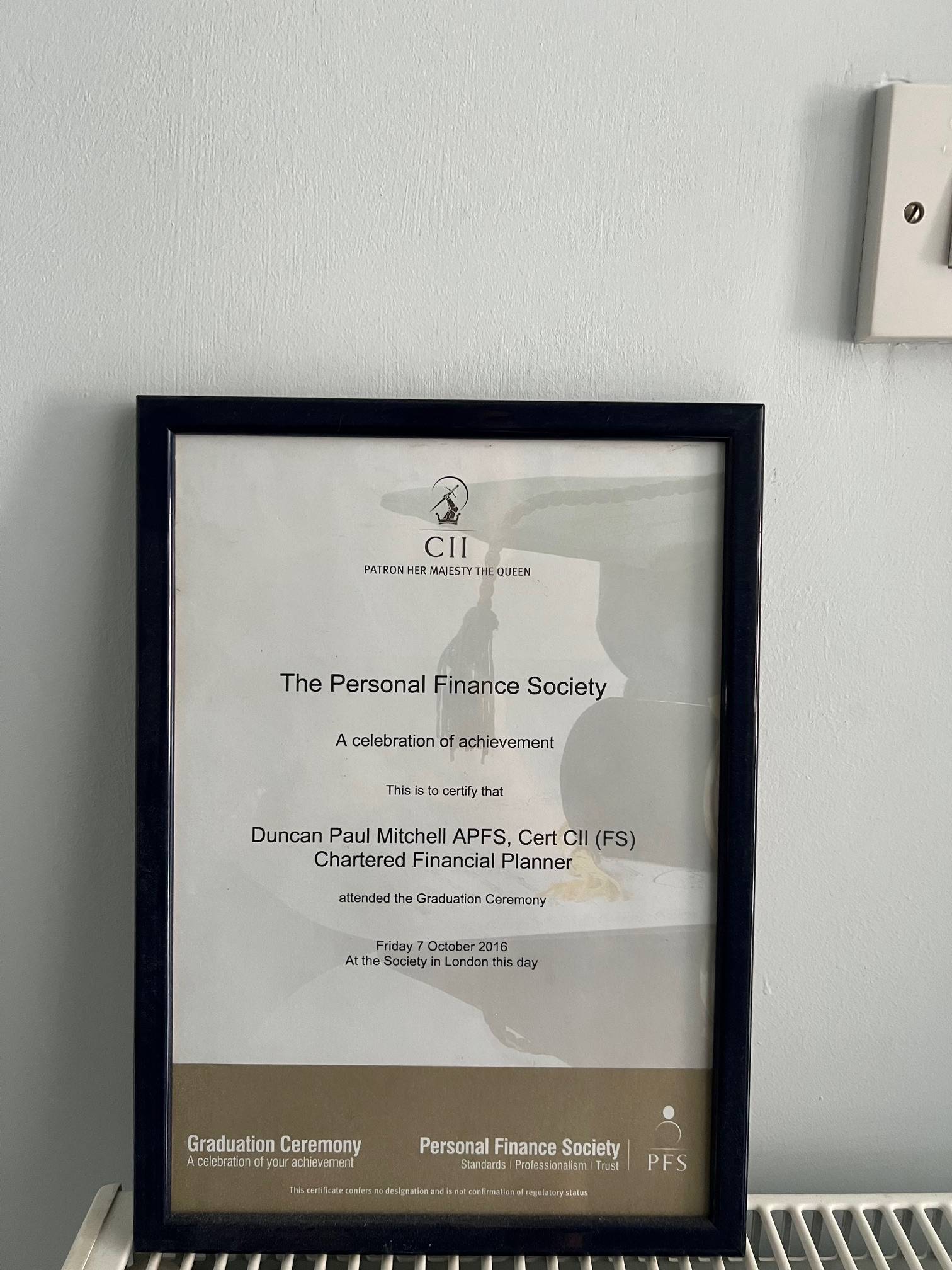

I can recommend Paul if you are planning for retirement or looking for financial coaching.